Portfolio Visualizer

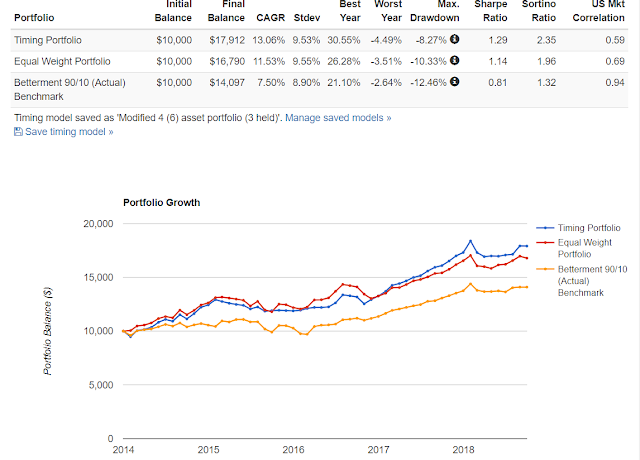

While I've written about my use of M1 and Betterment - and provided a high-level overview of what can be done, I have also been looking for ways to improve - including managing risk A great site you should consider is PortfolioVisualizer . It is a nice suite of tools that allow you to backtest various scenarios as well as run optimizations, backtests and simulations. Although my personally-saved portfolios can not be viewed directly, you can see one-such strategy I've been toying with here . Here's a quick snapshot of what I've come up with: The Hypothetical System: The Timing Portfolio consists of four ETFs: BND BNDX VTI VXUS UPRO TMF In this strategy, at the end of every month I look back over the prior 5 months and pick the 3 best performers and weight according to inverse volatility. It may be the same ETF selection for a few months with different weightings. It may be all selections from the list of ETFs. Every month you end up with a m