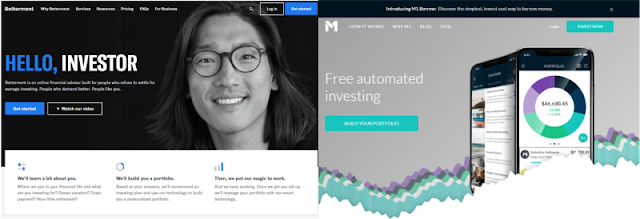

Betterment Vs M1

I've been investing with Betterment for a few years. Their approach is simple: make a goal - save for it. Much of the guesswork of picking investments is taken out of your hands and your money is applied to a tailored portfolio ideally designed to have a reasonable chance of meeting your goal.

These investment portfolios are constructed using modern portfolio theory with the idea of using low-cost index ETFs to achieve results. The fee for this service will run you ~.25% per year. There is very little choice, outside of a Goldman-Sachs derived portfolio option you can opt into. You can, to some degree, alter the risk profile of your portfolio (increase/decrease your stock/bond exposure) but the underlying investment choices are largely made up for you.

This is a great option for the passive investor who wants to put away money for simple goals such as:

- Saving for a mortgage down payment

- Saving for a down payment on a new car

- Saving for retirement

- Putting surplus savings into a Safety Net

- Beating yields on your savings account

You get fractional shares and automatic re-balancing for free. All deposits and dividend payments are re-invested to keep the portfolio balanced.

But there are other options in the marketplace. Recently I've started an account with M1 Finance. M1 Finance allows you to buy individual stocks as well a create a "pie". Pie's are a collection of investments that can include ETFs and stocks. You make your selection of investments and then allocate a percentage if your invested cash towards each investment. They also provide portfolios similar to Betterment's offerings if you don't feel like customizing your investments. In fact, you can largely clone Betterment's portfolios in M1 so long as you have a comparison account at Betterment.

Oh, and I forgot to mention - M1 is free. No additional fees outside regular ETF fees (if you choose ETFs). It was this little fact that led me to the idea that I can recreate what I'm getting from Betterment an even lower cost - no .25% advisory fee.

Case in point - Betterment released a new "Smart Saver" account that uses an 80/20 mix of short-term treasuries and short term, investment grade bonds respectively. The touted yield by Betterment is 1.83% net of Betterment and fund fees which is far higher than what you can currently get in a savings account or interest-bearing checking acccount. However, the combined fees erode a sizable percentage of the yield. On a small savings account, this amount is fundamentally minuscule and possibly irrelevant. On a larger account, it could represent enough to reconsider.

Comments

Post a Comment